Below sets the context for the series and my background. Want to jump straight into the detail, jump to part one.

Why embark on this journey? In recent years, I've witnessed far too many founders fail, unwittingly caught in the web of macroeconomic forces lurking in the shadows, hidden behind the bright lights of the funding and private equity market.

I'm sympathetic to the fact that part of this is by design. As we'll delve into, central banks aren’t banks at all. At the core, they are not much more than transmitters of desired monetary policy.

My background

This misunderstanding is something witnessed first hand on my acquisition journey during the 2021 post-covid e-commerce bubble.

I was CEO/Founder of Onport, a SaaS B2B company operating in the e-commerce arena A back-office solution for curated online marketplaces.

In September 2021, we were profitable, had a dozen amazing people and grown to $1m+ of ARR. We then started knocking on the doors of VCs to tell our story.

My initial expectations were modest. Our primary focus had been on developing a building a product, not a pitch deck. The pursuit of funding served as a litmus test to determine whether our creation held appeal beyond our existing client base. I assumed rejection while we refined our our story and future plans.

However, what transpired defied all expectations. VCs and companies were not just interested; they were clamouring to invest in our vision. We were had term sheets in our inbox within hours of pitching. The fervour was palpable as we had a number near/post IPO SaaS companies push acquisition offers with little strategic scrutiny.

This unusual dynamic underscored a critical realisation:

- We found ourselves entrenched in the midst of a SaaS valuation bubble.

- Few within this bubble recognised its existence.

In the midst of this bubble, I opted for acquisition, declining the generous investment offers from VCs. It was akin to walking away from a high-stakes poker game where everyone in the room assumed I held the winning hand.

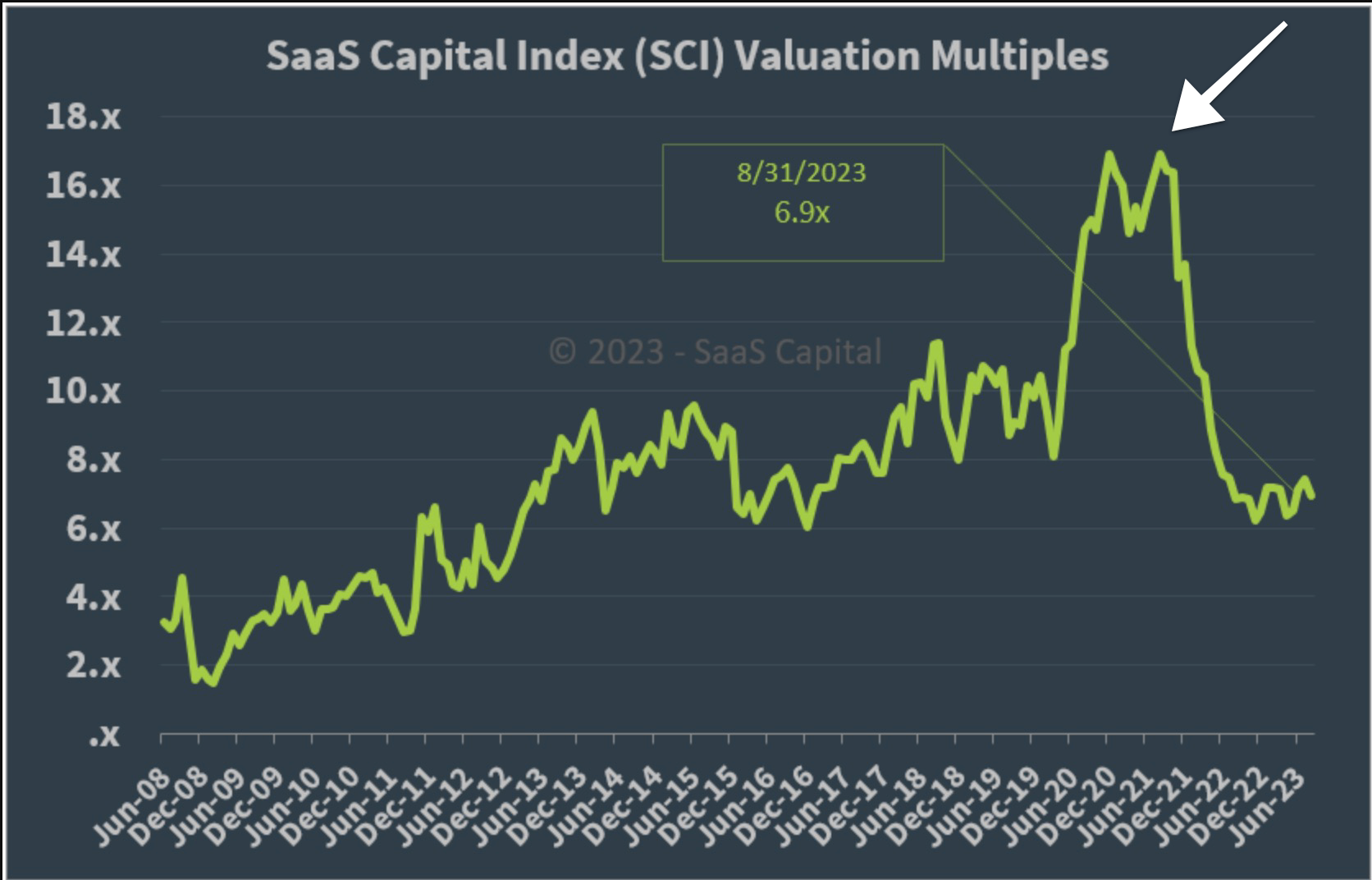

As a visual, we sold here:

For a few months after I folded and cashed in my chips, the casino carried on roaring. When speaking to these VCs, Founders, and CEOs during this period, there was a clear, pervasive groupthink—the FED was at the centre orchestrating the markets, like the all-powerful 'house' in the casino. There was a new Great Moderation. Growth curves up and to the right and forever. They were omnipotent and had the toolkit to fix any issues.

But then, as it often happens, the bubble burst and I witnessed the consequences of these misunderstandings. The casino lights dimmed, and the euphoria turned into panic. Suddenly, everyone turned on the FED, blaming them for their losses.

A new group think emerged. The FeD was to blame. Rampant "money printing", unleashing of “inflation” and historically fast interest rate hikes. VCs and founders were aligned in accusing the house of orchestrating a chaotic and losing hand.

Would-be acquirers pulled back from their IPO ambition. As of 2023, while mega-tech has rebounded and some new bubbles formed (AI), anyone unprofitable and bloated from VC money went busy or became zombies. Enough runway to keep going but significant dislocations between their pitch deck and actual revenues / growth curves.

It was a sobering reminder that in the world of tech and entrepreneurship, decisions carry weight and consequences. While my choice to fold and preserve my chips was the right one, it was impossible to ignore the challenges faced by fellow founders who had lost not just their bets but their entire ventures. It was a time for reflection, empathy, and a determination to understand the intricate factors at play in the casino of the financial world.

But, above all, few have learned. This post-bubble founder macroeconomic groupthink was just as unfounded mid-bubble one. Counter to perceptions, the FED doesn’t print money. QE doesn’t increase money supply. Low interest rates is not easy money. (Analogy).

Interestingly, these fallacies, such as equating Quantitative Easing (QE) to money printing and misunderstanding interest rates, persist until unrelated disruptions shake the very foundations of this belief system, causing a ripple effect that disrupts not the monetary system itself but rather the tech landscape. This pattern repeats itself as tech bubbles rise and inevitably burst. When these bubbles deflate, the Federal Reserve may respond with various measures, triggering a fresh round of collective misconceptions. This cycle reinforces the urgent need for founders to break free from these misunderstandings and gain a deeper understanding of the underlying macroeconomic forces. Tech founders need to grasp the true monetary plumbing, look beyond central bank policy transmission, and anticipate the tremors when they occur in the foundations of the monetary system.

Tech founders must delve into the true monetary plumbing, transcending central bank policy transmission and shedding misconceptions about the monetary system, to break the cycle and anticipate tremors when they occur at the foundational level of the monetary system.

Breaking the cycle

History repeats. These founders and CEOs are again looking at the FED. Waiting for a pivot. Back to QE, easy money and accommodative policies. It's a pattern we need to break.

Whether you're a budding SaaS entrepreneur, a seasoned industry expert, or someone eager to understand the intersection of tech and finance, this series is tailored for you. My goal? To clarify, debunk, and illuminate the intricate dance of global financial dynamics in relation to SaaS / Tech and founders.

Let's start with our first deep dive, unpacking the intricacies of QE. Or, view the full #MacroForMakers series.